It’s one of the hottest and constantly debated issues in Bangladesh. So I decided to dig down on this. And frankly, there was not much to go on, at least not enough that would give one a proper decisive answer to this question. Still, let’s try to unearth what’s in here.

If you google search “why is there no PayPal in ”, google will populate the search bar with country names like Pakistan, Bangladesh, Lebanon, Turkey, etc. It seems like the query is pretty common. It would be very clearly understood if Paypal had issued a statement, which they didn’t because they have to be diplomatic when trying to answer these questions. But it also means that rather than trying to find out why Bangladesh doesn’t have PayPal, one should focus on why PayPal operates where it operates and what makes PayPal go into a new market.

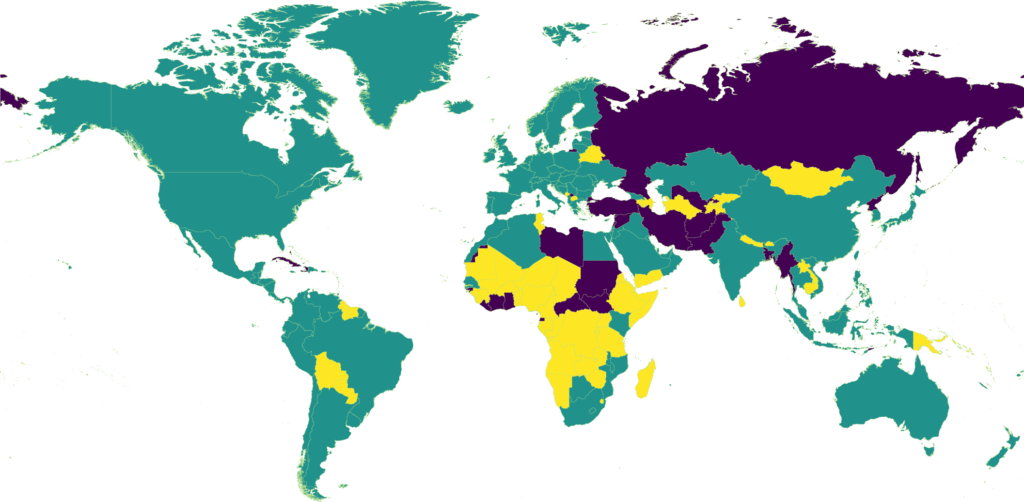

In the green-colored countries, PayPal operates fully, meaning people from these countries can use PayPal to send money, receive money and make payments.

In the yellow-colored countries, PayPal offers partial service. In these countries, people cannot receive foreign payments but can send money to other countries for goods and services

And in the dark violet-colored countries, PayPal doesn’t operate at all. You will find Russia here too. PayPal used to operate in Russia, but now after the Ukraine war started, they stopped providing services there.

Let’s take a look at an example. One of our closest neighbors, Pakistan doesn’t have PayPal. The likely reasons are:

- Pakistan is greylisted by Financial Action Task Force (FATF) since 2018. Meaning Pakistan is deemed to have a serious risk of money laundering and terrorism financing.

- Pakistan’s central bank and other regulators are not ‘friendly’ enough to accommodate PayPal.

You have to realize that PayPal is a behemoth company that has the option to pick and choose countries they want to operate in. And in the case of comparatively smaller countries, governments and regulators must cooperate with them.

And then there are countries like Iraq, Lebanon, Myanmar, Syria, etc where political instability, lack of governance, and small market size makes it almost not worth it for PayPal to venture into.

The above instances are crucial to understanding the case of Bangladesh. Strong regulations and their enforcement is important for PayPal to operate in a country. Keep in mind that there is more than one regulator/agency that PayPal needs to get clearance from in Bangladesh. The ICT ministry might say that they are trying to bring PayPal but they alone don’t have the authority to do so. It also involves the Bangladesh Bank and the Ministry of Finance. Bangladesh Bank has very clear MFS (Mobile Financial Services) guidelines and according to that, an MFS service has to be owned at least 51% by a bank. Also, the services need to keep their IT infrastructure and data centers physically within Bangladesh.

Which brings us to our second example: Turkey. Turkey actually had PayPal. But back in 2016 their Financial regulatory agency refused to renew the payments license to PayPal, making them leave Turkey altogether. But the reason for not giving the license is something that will interest us. According to a PayPal spokesperson, the Turkish regulators asked that the entire IT system and data center required for PayPal’s Turkish operations be physically located in Turkey, which made PayPal leave the country.

But Bangladesh is a big market, right? Although it is to some extent, the market PayPal can address is pretty small. The market that bKash has penetrated is very informal; the distribution channel requires many stakeholders like agents, distributors, etc. And PayPal simply isn’t trying to pursue that offline-heavy business model. In Bangladesh, PayPal is mostly beneficial to freelancers as it makes it easy for them to get paid from overseas jobs. What they need is the option to receive money. Now on the map, notice a pattern among the countries that have this ‘receive money’ option vs the ones that don’t. You will find that PayPal supports money receiving services in countries that have one or all of these:

- Strong financial governance and transparently enforced regulations

- Massive market size.

- Free movement of capital

Let’s look at Sri Lanka on the map above. They had ‘send money’ service for years, but cannot yet manage for Paypal to open up the ‘receive money’ service. Bangladeshi freelancers also need this ‘receive money’ option to get payments from abroad. But PayPal allows this service after far more scrutiny than ‘send money’. This is because PayPal also has to worry about the payment sender’s security. They have to make sure that if a country has the ‘receive payments’ option, then it also has the necessary framework for arbitration in case there needs to be a ‘refund’. And issuing a refund means money going out of the country. Imagine if Bangladeshi freelancers receive money for their service, but cannot issue a refund if the service doesn’t meet conditions. They will not have any way to do so given Bangladesh Bank’s regulations on money outflow.

That brings us to ‘send money’. Even if PayPal opens this service in Bangladesh, it won’t be very useful because Bangladeshi dual-currency credit/ debit cards can already make payments for services internationally.

Meanwhile in 2016, Bangladeshi authorities made a dog and pony show regarding PayPal owned Xoom’s deal with Sonali Bank. Xoom, by that time had already been operating for years with other Bangladeshi Banks. Xoom is in fact just a strictly person-to-person money transfer service just like Western Union. It cannot be used to get business payments. And Bangladeshi authorities don’t really care much about PayPal’s service to send money out of Bangladesh. What is needed here is the ability to ‘receive money’. And that is hard to qualify even for countries that already have a PayPal presence.

Now, Paypal also operates in China and India. Mostly because the markets are too big to ignore for a financial company that is trying to bring as many people as possible within its network. And to do that, they are willing to set up costly bases in these countries to work more closely with the regulators on a priority basis.

For example, in Egypt, PayPal did not operate before but later decided to enter the market. It has 100 Million people, $3,500 per capita GDP, and is one of the biggest markets in the MENA (Middle-East and North Africa) region. But it doesn’t operate in Lebanon, simply because the market is too small for PayPal to make the effort.

This is something we need to remember. Paypal has priorities: it can be geographic or strategic. And Bangladesh can do everything right and PayPal can still decide it’s not worth it to venture into. Or even if it does, might not offer the exact services Bangladeshi freelancers need it for.

Note: This topic was suggested to me by a reader. It was a fascinating days long research. If you have any specific topic you want covered, please contact via social media or email.